Direct or Regular ?

Almost Every mutual fund comes under two versions- Direct plans and regular plans. The main difference between the two is that regular plans have a distribution commission and direct plans don't.

But is that the only difference? And does that really matter to an investor? well, yes it does matter. To elaborate this, let us see how direct plans are better than regular mutual fund plans.

1. Higher returns

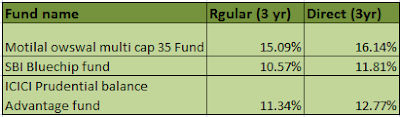

The returns of any direct mutual fund are always higher than the regular version of the same mutual fund.

One of the key factors which influence a mutual fund investment decision is the return. The return of a mutual fund is usually calculated on 1 year, 3 years, and 5 years basis to represent the traditional investment horizon.

The returns in case of direct mutual funds are always higher than their regular counterparts.

Here are a few examples.

2. Low Expense Ratio.

The expense ratio (fees charged by the mutual fund company) is much lower in direct mutual funds.

Most people, when investing in mutual funds, tend to take the help of their preferred mutual fund advisor or from their local financial service advisory.

but obvious that the fee paid to the advisor comes out of investors pocket. The fee is deducted straight from your investment amount and paid to the advisor or agent.

This fee is deducted as a percentage of your investment by the mutual fund house and generally varies between the range of 0.5% to 1%.

When investing in a direct fund, no commission fees or distribution charges can be deducted by the AMC (as deemed by SEBI). The expense ratio is much lower as the mutual funds are not paying any commission to the brokers. It saves a general investor a ton of money over their investment horizon.

For example, look at this comparison between the returns of SBI Bluechip Fund (regular plan) and SBI Bluechip Fund (direct plan.)

3. Higher NAV.

NAV is an abbreviated form of the term Net Asset Value.

It represents the value of a mutual fund and is determined by calculating the total assets owned by the fund and dividing it by the number of units outstanding.

The assets owned by the fund generally vary between debt instruments like debentures and bonds and equity instruments like company shares.

In some cases, cash might also be a part of the assets owned. The total tally of these instruments is calculated to arrive at the assets owned by the fund.

If the fees paid to the agents can be avoided, then the amounting NAV is higher.

As a result, direct funds have a higher NAV than regular funds of the same mutual fund. As a result, your total investment value is higher in a direct fund.

Let’s take the help of an example to understand exactly how this might affect you:

4. Control is in your hand.

Unlike regular plans, the distributors don't have any role to play in controlling the management of your money. Indirect funds you are always at the driving seat. You take charge of your money and directly deal with the AMC here by cutting the involvement of distributor.

In case of direct funds, you are in fact, encouraged to interact and consult with the AMC directly.

Since you never had the complete understanding of the inner workings of the process at AMC, even updating your KYC might seem like an uphill task. In such a case, it is better to have a professional advisor handle your portfolio. As all these cohesive works can be managed easily by them.

As they educate you with regards to the procedural mechanisms and even negates any discrepancy created. All in all, it makes you a better and more planned investor.

Though in the direct plans you always have the control in your hand it is always advisable to consult an expert or your distributor for a periodic review of the performance of the chosen fund if you are not an active investor.

Note: The data used is sourced from www.valueserchonline.com and pertains to 19th-February- 2019.

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

StockTrading

Stock Trading

Share Trading

Share Trading

Great Information! Its looking Nice

ReplyDeleteYou can invest in stocks yourself by buying individual Stocks & Shares....Did you know Stock market,Sensex,Trading,Forex...etc For more Information Visit our site (Stockinvestor.in)

dynamic asset allocation funds

emkay global financial services ltd

sbi bluechip fund

jk bank

nestle stocks

sbimutual fund

shriram transport finance share price

shriram transport finance share price

Your article gives some good information. Every one to get knowledge of any fund, before invest. Ex: What is New Fund Offer. Understanding about New Fund Offer Importance.

ReplyDeleteI just came across this site and found this informative blog about dentistry. Thanks for sharing. Realy, it's a great blog. I think Sell Reliance Industries Ltd. may useful for you. Check once and get more facts.

ReplyDeleteAntony Waste

Individual Investors

Individual Investors

Best Information! Its looking Nice.....Keep it Up!

ReplyDeleteYou can invest in stocks yourself by buying individual Stocks & Shares or mutual funds,IPOs, or get help investing in stocks

Click this keyword.........

NEWS

Expert-Views

What-Is

Best-to-Invest

Commodity-Online-Ttrading

IPO

Mutual-Ffunds

Ipo-News

If you don’t have time to read the entire topic and just want to find out what the Best stock For long-term investment. Here is for you...

ReplyDeleteManappuram Finance private placement

RIL group

Zoom app

Sundar Pichai compensation

It is really a great and useful piece of info. I’m glad that you shared this helpful info with us. Please keep us informed like this. Thank you for sharing.

ReplyDeletemutual fund advisor

Thanks for sharing the information. That’s a awesome article you posted. I found the post very useful as well as interesting. I will come back to read some more Muthoot Fincorp Ltd.

ReplyDeleteThanks for sharing the information. That’s a awesome article you posted. I found the post very useful as well as interesting. I will come back to read some more sensex

ReplyDeleteNice article thanks for sharing such a valuable information with us.you may also check our blog for more information

ReplyDeletemoratorium

DHFL defaults on NCD

Good information. Thanks for sharing. If you want to know more about stock market related topics then visit

ReplyDeleteSimple Moving Average

Scalp trading

Commodity trading

Hey...Great information thanks for sharing such a valuable information

ReplyDeleteSBI Mutual Fund

SBI FMP Series 16(1116 Days)

Non-UTI Mutual Fund

Nice post ! I am very interesting to read your blog content.Thanks for sharing.you may also check our blog

ReplyDeleteCeinsys Tech Ltd

Really great blog ! I bookmarked your blog to read your posts.Thanks for sharing

ReplyDeleteHindalco Industries share price

Hindalco Industries stock

Aditya Birla Group firm

SBI Life shares