Residential Status - Are you OR, NOR or NR ?

Determination of residential Status is very important for the filing of the income tax return as income tax is charged on the basis of the residential status of the taxpayer.

The period of stay in India is the base for determining the residential status of the taxpayers.

If any person satisfies any one of the following conditions, he will be considered as the resident of India during the relevant financial year.

The conditions are:

1. He is in India for a period of 182 days or more, during the relevant financial year.

OR

2. He is in India for 60 or more days during the relevant financial year and has been in India for 365 days or more during the 4 financial years immediately preceding the relevant financial year.

If any of the above condition is satisfied by the person than he will be said to be the resident of India. If he doesn't satisfy either of the two conditions, he will be treated as non- resident (NR).

Exception:

In below-mentioned cases, the person shall be considered to be resident in India only if he fulfills the first condition of 182 days. That means the second condition of 365 days in 4 preceding years is not applicable in two below-mentioned cases.

The two exceptions are :

1. In case of an individual who is a citizen of India and leaves India for the first time during the relevant financial year for the purpose of taking employment outside India.

2. In case of an individual who is a citizen of India or is a person of Indian origin who being settled outside India visits India during Relevant financial year.

The resident person can further be divided into two more categories, namely ordinary resident (OR) and non- ordinary resident (NOR). The criterion to decide these categories is as follows:

1.) He should be a resident ( as per above conditions) in 9 out of 10 years immediately preceding the relevant financial year.

OR

2) His stay in India during the immediately preceding 7 years should be 729 days or less.

If any resident fulfills any one of the above-mentioned condition, his status shall be of an ordinary resident. If any resident doesn't fulfill either of the condition he shall be considered to be non- ordinary resident.

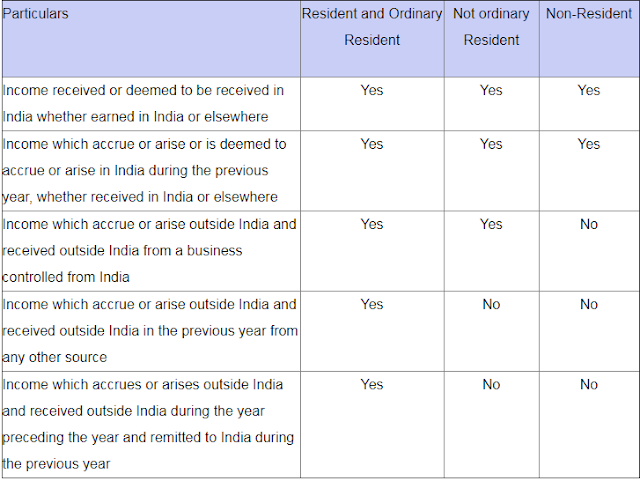

Now, that we understand various residential status let us look at how each of these statuses is taxed.

It is to be noted that any income shall be treated to be received in India only if it is first received in India. If any income is first received outside India and later transferred to India, it won't be treated as income received in India

The thing to be noted here is the difference between the residential status and the nationality or citizenship of a person. A person can be a citizen of India and still may not be a resident in India and similarly, a person can be a citizen of some other country and still be resident in India and can be liable to tax in India.

The period of stay in India is the base for determining the residential status of the taxpayers.

If any person satisfies any one of the following conditions, he will be considered as the resident of India during the relevant financial year.

The conditions are:

1. He is in India for a period of 182 days or more, during the relevant financial year.

OR

2. He is in India for 60 or more days during the relevant financial year and has been in India for 365 days or more during the 4 financial years immediately preceding the relevant financial year.

If any of the above condition is satisfied by the person than he will be said to be the resident of India. If he doesn't satisfy either of the two conditions, he will be treated as non- resident (NR).

Exception:

In below-mentioned cases, the person shall be considered to be resident in India only if he fulfills the first condition of 182 days. That means the second condition of 365 days in 4 preceding years is not applicable in two below-mentioned cases.

The two exceptions are :

1. In case of an individual who is a citizen of India and leaves India for the first time during the relevant financial year for the purpose of taking employment outside India.

2. In case of an individual who is a citizen of India or is a person of Indian origin who being settled outside India visits India during Relevant financial year.

The resident person can further be divided into two more categories, namely ordinary resident (OR) and non- ordinary resident (NOR). The criterion to decide these categories is as follows:

1.) He should be a resident ( as per above conditions) in 9 out of 10 years immediately preceding the relevant financial year.

OR

2) His stay in India during the immediately preceding 7 years should be 729 days or less.

If any resident fulfills any one of the above-mentioned condition, his status shall be of an ordinary resident. If any resident doesn't fulfill either of the condition he shall be considered to be non- ordinary resident.

Now, that we understand various residential status let us look at how each of these statuses is taxed.

It is to be noted that any income shall be treated to be received in India only if it is first received in India. If any income is first received outside India and later transferred to India, it won't be treated as income received in India

The thing to be noted here is the difference between the residential status and the nationality or citizenship of a person. A person can be a citizen of India and still may not be a resident in India and similarly, a person can be a citizen of some other country and still be resident in India and can be liable to tax in India.

Comments

Post a Comment