Portfolio Management

Investing in financial securities such as shares, debentures and bonds is considered one of the best avenues for investing. These investments are profitable as well as exciting. Investing in such instruments involves both rational as well as emotional responses. It is indeed rewarding but at the same time involves a great deal of risk.

It is very often (and not even suggested) to find investors putting their entire savings in a single security. Instead, it is always better to invest in a diversified pool of securities. Such a pool of securities is called a portfolio. Creation of a portfolio helps to reduce risk without sacrificing the returns. An optimal portfolio is one which minimizes the risk and provides a higher return. Therefore, this makes portfolio management a very important aspect of your investments.

2. Portfolio Analysis:

It is very often (and not even suggested) to find investors putting their entire savings in a single security. Instead, it is always better to invest in a diversified pool of securities. Such a pool of securities is called a portfolio. Creation of a portfolio helps to reduce risk without sacrificing the returns. An optimal portfolio is one which minimizes the risk and provides a higher return. Therefore, this makes portfolio management a very important aspect of your investments.

What is Portfolio Management?

Portfolio management means strategically managing an investment portfolio, by selecting the best investment mix the right proportions and periodically shifting them in the portfolio to maximize the returns and minimize the overall risk of the portfolio. Portfolio management involves deciding about the optimal portfolio, matching investment with the objectives, allocation of assets and balancing risk.

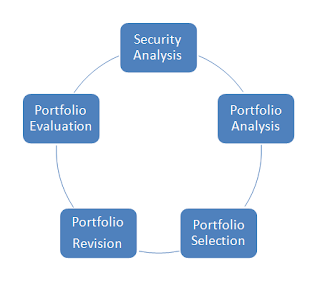

Portfolio Management process.

Portfolio management is a process which involves many activities aimed to optimize the investment of one's fund. It is a five-step process and each step is an integral part of the whole process. The success of the portfolio depends upon the efficient completion of each step.

The five steps are as follows:

1. Securities Analysis:

It is the first step of the portfolio creation process, which involves assessing the risk and return factors of individual securities, along with their correlation. These steps consist of examining risk-return characteristics of individual securities. A basic strategy securities investment is to buy underpriced securities and sell overpriced. This is what security analysis is all about. There are two alternatives approaches to security analysis, namely fundamental analysis and technical analysis. They are based on different principals, mindset and techniques. Will cover them in the different article in details, for now, let's do away with the names only.

2. Portfolio Analysis:

After determining the securities for investment and the risk involved, a number of portfolios can be created out of them, which are called as feasible portfolios. This step consists of identifying the range of possible portfolios that can be constituted from a given set of securities and calculating their return and risk for further analysis.

3. Portfolio Selection:

The goal of portfolio construction is to generate a portfolio that provides the highest return at a given level of risk. A portfolio serving these characteristics is known as an efficient portfolio. The inputs from the previous steps can be used to identify the set of efficient portfolios. From these set of the efficient portfolio, the optimal portfolio has to be selected for investments.

4. Portfolio Revision:

Once the optimal portfolio is selected. The next step is to have a periodical review on the portfolio to make sure it remains optimal even after the economic, cyclic and market changes carried over time. This is steps becomes a necessity and has to be carried regularly to make sure your portfolio keep generating a return for the long term.

5. Portfolio Evaluation:

In this step, the performance of the portfolio is assessed over the stipulated period, concerning the quantitative measurement of the return obtained and risk involved in the portfolio, for the whole term of the investment. If the results of portfolio revision state that it has lost its optimality, all the necessary changes, inclusion and deletion has to be made in this step.

The process of portfolio management is a continuous process. Hence, once you are done with all five steps. You will have to repeat the all or few steps of the process again based on your specific requirement.

It is really quality & outstanding post. keep it up!

ReplyDeleteLatest stock market news and updates on the stockinvestor...buy or sell stock ideas by experts for minute to minute updates...

StockTrading

Stock Trading

Share Trading

Share Trading

Great Information! Its looking Nice

ReplyDeleteYou can invest in stocks yourself by buying individual Stocks & Shares....Did you know Stock market,Sensex,Trading,Forex...etc For more Information Visit our site (Stockinvestor.in)

dynamic asset allocation funds

emkay global financial services ltd

sbi bluechip fund

jk bank

nestle stocks

sbimutual fund

shriram transport finance share price

shriram transport finance share price

This is a great article thanks for this informative information. I will visit your blog regularly for some latest post. I will visit your blog regularly for Some latest post.

ReplyDeletetax return for self employed in London