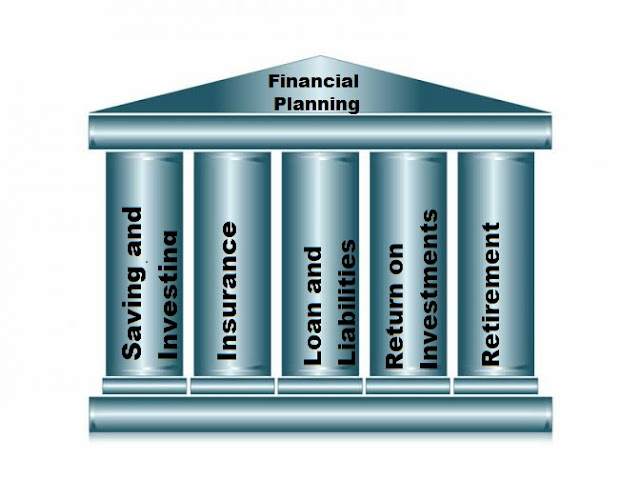

Financial Planning Pillars

The success of a financial journey requires some detailed view and technical approach. Possessing these two at the same time is a hard task for many. However there are few things if kept in mind, will always help you maintain your finances smoothly. In our financial life we need to consider the following points to be of the optimal necessity:

- Savings and investing

- Insurance

- Loan and Liabilities

- Returns on investment

- Retirement

1. Savings and investments.

a. Maintaining an emergency fund: The first and most basic approach for saving is to keep aside some portion of earnings for an emergency. Maintaining an emergency fund helps you to be prepared for some unforeseen event. Since you at the back of your mind you know you are having some backup in case of some uncertainty, you will be willing to take some extra risk while investing.b. Deciding an asset allocation for your portfolio: one of the most important factors for developing a sustainable investment portfolio is deciding the optimum asset allocation. Asset allocation is basically deciding what portion of your money will be allocated in which asset class. So that there is some diversification and you don't park all your money in one or few asset class. Deciding your asset allocation helps your portfolio to grow even if one or two asset class isn't performing for some time.

2. Insurance

a. All you need is term insurance: We all have that one uncle who is breathlessly chasing us to pitch us various insurance scheme regardless of the fact it suits our profile or not. When it comes to insurance all you need is term insurance that covers your family and maybe health insurance along with it. Do not fall for any other lucrative scheme.b. Taking the right sum assured: The rule says one should have a sum assured of 8- 10 times of his/ her annual income. Though the rule may suit some of us the optimal one has to be decided based on your personal liabilities, goal, and requirements, However, on average it has to be 12-15 times if you are in your early 30s and 6-8 times of your annual income in your 50s.

3. Loans and Liabilities:

a. Quantify your loan: Experts says loan amount should ideally be around 60-80% of the required amount. So if want to buy a house of 1 crore than ideally, the loan amount should be 60-80 lakhs.b. Monitor your bills and liability: A sound financial planning is only possible only if you keep an account of short term and long term liabilities. for example, a simple step of paying your credit card bill on time may save you from paying late payment interest, which can be utilized as SIP for any of the goal.

4. Return on investment

a. Know the effect of taxation: Always compare the post-tax return of the investment option available to you. An investment which is offering you a return of 10 percent might actually pay 7 percent only post-tax.b. Payback period: Payback period refers to the time taken by an investment to recover its initial cost. for example, if the investments costs Rs 50000 initially and give a return of 15 percent annually, then the payback period of this investment shall be 6 years and 8 months.

5. Retirement

a. The amount you will need at your retirement: The best way to achieve something is to plan it. If you want to have a peaceful post-retirement life you got to plan it. Plan out the life goals and the amount you will be needing for those goals.b. How much should you invest every month to reach your retirement goal: New generation is in some different mood they would like to enjoy the present & have no idea about the future. If you have just started to work & would like to have a very simple lifestyle & retirement at the age

of 60 you can do it with saving (read investing) 10% of your income. If you are planning for an early retirement start with 20% savings. Other rule says if you are in early 30s Save 10% for basics, 15% for comfort, 20% to escape. If you are late by decade add 5% more in each category.

If you keep all these pillars under a regular review and correction, your financial health will always be in good condition. Do let us know your experience and views regarding your management of each of these points.

Hey, thanks for the information. your posts are informative and useful. I am regularly following your posts.

ReplyDeleteHCL Technologies, Kotak Institutional