TDS, advance tax and Self- assessment

There are three mediums by which an individual pays taxes in India.

1. Advance tax

2. TDS

3. Self Assessment Tax.

What Is TDS?

TDS stands for the tax deducted at source. As per income tax act any person, making a payment is required to deduct tax at source if the payment exceeds the certain threshold limit at the prescribed rates.

The person who makes the payment after deducting the tax at source is known as the deductor and person to whom payment is made i.e. the receiver is called deductee. The deductor is liable to deduct tax while making the payment to deductee and later deposit the same to the government.

TDS has to be deducted irrespective of the mode of payment and has to be linked to the PAN of deductor and deductee.

It is to be noted that individuals are not required to deduct TDS on the payment of rents and professional fees paid by them.

TDS is on basics is close to advance tax as it has to be deposited periodically with the government. The deductee can claim the TDS deducted while filing the return of income.

What is Advance Tax?

Income tax paid in advance instead of a lump sum payment at the year-end is known as an advance tax. the advance tax is paid in installments as per the guidance and due dates provided by the income tax department.

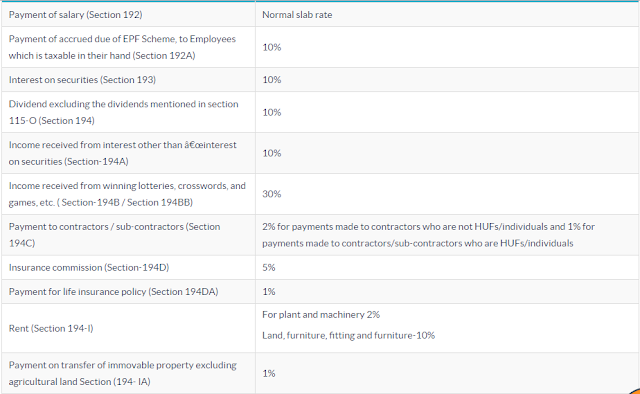

TDS Rates Applicable For FY 18-19

Who is Liable to pay Advance tax?

Salaried, freelance and business - If total tax payable for any person in any financial year is more Rs.10,000 or more than the person is liable to pay advance tax. All the taxpayers are covered by the advance tax. However, a senior citizen who is not having income from any business is exempt from advance tax and have to tax while or before filing a return of income.

Presumptive Income for Business- taxpayers who have opted for the presumptive scheme have to pay the whole amount of their advance tax in one installment on or before 15th March.

Due Dates For payment Of Advance Tax

What is self Assesment Tax?

Total tax liability less TDS deducted and advance tax paid during the year is known as self-assessment tax.

Let's understand this with the help of an example:

Suppose your income during the year is Rs 10 lakhs. So gross tax payable is Rs. 1,12,500 excluding cess. TDS deducted is 20,000 and advance tax paid is 25,000.

Therefore, the self-assessment tax is 67,500 which is to be paid on or before the filing of return of income.

Comments

Post a Comment