NPS - A good investment for retirement Planning ?

The reality of retirement planning isn’t as dramatic as it sounds. It is, in fact, easier if you start early because you never know what befalls in the future. So where do you get started? What could you possibly do effortlessly to save for your post-retirement days and not depend on other family members?

Well, We have talked about retirement planning many times before so in this post, we won't be taking up the details regarding retirement planning.

In this article, we are going to be discussing one of the most famous and most ignored retirement planning instruments NPS.

Yes, you have read that right I used two contradict words in the last line but apparently, it is true. NPS has become one of the most talked-about and famous investments and retirement tools. Yet a lot of us don't know what it is actually about.

Hopefully, by the end of this article, you would be at least able to judge if you took the right decision by investing or ignoring the NPS.

But before we start understanding the NPS, let me tell you about an investment that is governed and promoted by the government ensuring maximum safety and gives you a return at almost equal to the mutual fund investments, and is highly tax-efficient. Seems interesting ?? Well, that's NPS for you in a nutshell.

So, What is NPS?

The National Pension Scheme (NPS) is a long-term retirement plan that allows you to make voluntary contributions and get a lump sum payment as well as regular income after retirement. The scheme is sponsored by the government of India and regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

In NPS, your money is invested in various assets by a pension fund manager to help you build a sizable retirement fund. Upon retirement, you can withdraw 60% of the retirement fund and invest the remaining in an annuity plan for regular income during retirement.

How Does NPS work?

When you open an NPS account, you are allotted a Permanent Retirement Account Number (PRAN). Contributions from your salary are made directly through the employer to your PRAN. When you attain the age of 60 or exit the scheme, the fund is made available to you. If you continue making contributions to the NPS until you retire, you will be able to withdraw 60% of the retirement fund while the remaining 40% will go towards providing you regular retirement income.

As a subscriber of the National Pension Scheme (NPS), you get the option to choose between four different types of funds such as equities, government securities, corporate debt and alternate assets. However, the privilege to choose between funds is only available if you decide to go for an Active account. If you opt for Auto, the funds will be automatically allocated to the four different funds. With Active choice, you can change your fund allocation according to your risk appetite, investment goals and market conditions.

The NPS has its share of income tax benefits both at the time of making contributions and at the time of withdrawal on maturity. Individual taxpayers can claim deduction on contributions under Tier I NPS up to Rs 1.5 lakh in a financial year under Section 80C. Further, NPS subscribers can claim an additional deduction for investment up to Rs 50,000 in Tier I account in a financial year under Section 80CCD (1B) over and above the Rs 1.5 lakh deduction under Section 80C. However, contributions to Tier II do not provide any tax benefits.

NPS Withdrawal on Maturity

When you reach the maturity age, which is 60 years, you can withdraw the entire corpus from Tier I, of which only 60% is exempt from tax as with the remaining 40%, one has to purchase an annuity mandatorily.

An annuity is a fixed sum of money that you receive every year for your lifetime. An annuity is purchased by paying a lump sum to the seller, which is an insurance company. There are different types of annuities to suit the different needs of the annuitant. Remember, an annuity is treated as income and added to your other income sources and taxed as per the tax slab you fall in. Likewise, the entire corpus under Tier II is fully taxable as it is treated as income.

Now that we know the brief about NPS, the big question is should you invest in the NPS?

Let's take an example and analyze is it really a good investment option by taking an example of a 30 year old person, who is working at a MNC.

Since, NPS allows maximum 75% allocation in the equity its growth is range is ristricted as comapred to other option avialble like stocks or pure equity mutual fund.

Since a young person has long tenure ( 30 years in above case) it would not be recommend NPS for investors below the age of 45 years. Those above 45 years could consider NPS only if they are fine with locking in their capital for 15 years and have more than ample liquidity outside this product. Investing for more than the ₹50,000 additional benefit (under Section 80CCD (1B)) would result in a large amount of capital getting locked in, which is not recommended.

But Wait.... what about the tax on with drwal? Since, NPS allows to withdraw 60% tax free at 60 obviosuly noting can beat that. That like 60% less tax as compared to other investments.

Well not excetly!! NPS do offer 60% tax free but there is a small inherent advatage to equities and other product. Let's see how..

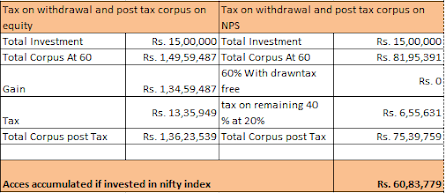

Relating the above calculation with the table below:

But Wait.... what about the tax on with drwal? Since, NPS allows to withdraw 60% tax free at 60 obviosuly noting can beat that. That like 60% less tax as compared to other investments.

Well not excetly!! NPS do offer 60% tax free but there is a small inherent advatage to equities and other product. Let's see how..

Relating the above calculation with the table below:

As clearly seen despite the 60% tax free amount equities and related product managed to out perform the NPS in terms of net corpus accumulated.

How did that happen??

Well that is simple in case of mutual funds and equity investmetns the tax is only charged on your gain amount and that is also first 1 lakh is exempt and remaing gain is taxed @ 10%.

Where as in case of NPS tax is charged on the actual balance available at 60 which also included your invested amount apart from the gain portion.

So, does all this mean one should avoid investing in NPS?

Well if the purpose is to accumulate the best possible retirment corpus there are certainly better options then NPS.

However, it will also depend person to person and their over all choices. If you want the safest option with optimul return then definately NPS is the best option for you. But even in that case it won't be a prudent decision to invest anything above Rs. 50,000 into the NPS.

Also it is always advisable to consult your financial advisor for making the investment decision as there are so many variables in making the such cauluation of any person's profile.

However, it will also depend person to person and their over all choices. If you want the safest option with optimul return then definately NPS is the best option for you. But even in that case it won't be a prudent decision to invest anything above Rs. 50,000 into the NPS.

Also it is always advisable to consult your financial advisor for making the investment decision as there are so many variables in making the such cauluation of any person's profile.

Note: Views expressed above are solely the author's perspectives. Readers are advised to keep their discretion insight and consult their financial advisor before making any investment.

Also Read:

Comments

Post a Comment